option to tax certificate

For Initially Bought. Email HMRC to ask for this form in Welsh Cymraeg.

Tips For Buying Tax Exempt Textbooks Textbook Tips Tax

A tax certificate indicates whether real property taxes for a specific property are in arrears as well as unpaid obligations for DC water and sewer charges Clean City liabilities Business Improvement District BID taxes.

. Combining the benefits from tax saving on the initial investment tax savings on interest earned and the guaranteed returns offered makes NSC a favoured investment option. Option 2 a bit more complicated. Some states offer the option of verifying the closure through the states website.

Fully complete the information in tabs 1 through 4 before providing your vendor with an electronic copy of the. 2 based on the option elected on the Contractor Registration Database. A new page of Tax Certificate will open here you can see start month.

Especially if the state uses the notice in lieu of issuing a clearance certificate. The search tax licenses page of the Hawaiian Government lets a user verify the resale certificate after clicking on the tart over option. Licenses permits grants contracts if there is a debt owed to the District of Columbia of more than 100 for fees fines taxes or penalties.

How does an organization apply for a Virginia retail sales and use tax exemption. Moreover the estate has the option of obtaining from the IRS free of charge an account transcript showing certain information from the estate tax return comparable to that found in a closing letter. Issuing a creditable withholding tax certificate or BIR Form No.

But opting out of some of these cookies may affect your browsing experience. If your resale certificate is expiring. For detailed information on exemption requirements go to Retail Sales and Use Tax Exemptions for Nonprofit Organizations.

The Tennessee Sales Use Tax Guide provides the rules regarding exemption certificates and resale certificates beginning on page 41. It also includes the legal description municipal address of the property and the monthly payment information if applicable. Option 4 or email at Businesstaxlagov.

Add the starting and ending date year. Option 1 easy method. Updated in January 2022 here is more information about Tennessees repeal of the previous drop shipment rule that grants retailers the option to use the Streamlined Sales and Use Tax Certificate.

Andor failure to file required District tax returns. To save business owners time and money the City of Fresno now offers an E-check option for paying business tax renewals. Idaho From the Idaho official website clicking on the start over option leads to validate permit option.

If you do not have a LaTAP account it will be necessary to establish one. You also have the option to opt-out of these cookies. Register with ZIMRA submit all required documentation and apply for the tax clearance certificate.

Go to Nonprofit Online or complete Form NP-1 and submit it to Virginia Tax Nonprofit Exemption Unit P. Resale Certificate Print Resale Certificates. Box 27125 Richmond Virginia 23261-7125.

Tax certificates reflect the most current general taxes and special assessment fees intended for real property purchases as outlined under DC Official Code 47-405. I waive the option to have the payment treated as a deposit under section 6325b4 and the right to request a return of funds and to bring an action under section 7426a4. To make tax-exempt purchases of building materials and fixtures Option 1 or Option 3 contractors must complete Form 13 Section C Part 1.

There you can see the Tax Certificate option select it. Instead of paying a 23 convenience fee with a credit card business owners can now choose to pay with E-check with a flat fee of 089 per transaction regardless of the amount owed. Also you have the option of opting for tax exemption on interest earned under section 80C further increasing the net return from the investment.

As noted in the final regulations account transcripts can be used to confirm that an estate tax return examination has been completed and the. Use certificate VAT1614G to disapply the option to tax land sold to housing associations. You will have the option to also search for condominium accessory.

In the end click on the download button your selected year certificate will download. If you cannot validate the account or location ID and need further assistance please contact LDR at 855-307-3893. A tax clearance certificate is a document issued by a state government agency usually the Department of Revenue.

Electronic Wisconsin Sales and Use Tax Exemption Certificate You may use the electronic certificate S-211E to claim an exemption from Wisconsin state county baseball stadium local exposition and premier resort sales or use taxes. What Is a Tax Clearance Certificate. The procedure for obtaining tax clearance in Zimbabwe is as follows.

Use form VAT1614D to disapply the option to tax buildings for conversion into dwellings. To make tax-exempt purchases of building materials and fixtures. Apply for permission to opt to tax land or buildings Use form VAT1614H to apply for permission to opt land.

Order tax clearance and well do it for you. Select the option 5th Usage which will give you more new options. A Tax Certificate shows the amount of property taxes imposed in the year the amount of taxes owing and the total amount of tax arrears if any.

Application for Certificate of Discharge of Property from Federal Tax Lien Department of the Treasury Internal Revenue Service. Pursuant to a construction project for an exempt governmental unit or. The District of Columbia Clean Hands mandate DC Code 47-2862 stipulates that individuals and businesses are to be denied city goods or services eg.

In RMC 85-2011 this obligation of withholding tax agent is reiterated. Opting to tax land and. 2307 is an obligation of the payor withholding tax agent to the payee.

My Website Monetization Blog Has Submitted For Us Tax Info Website Monetization Monetize Us Tax

Lots Of Giftcertificate Orders Lately Have You Given One Yet Give Them The Perfectgift Of Creating An Origamiowl Origami Owl Lockets Origami Owl Origami

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

9 Salary Certificate Template Doc Excel Pdf Psd Certificate Templates Salary Templates

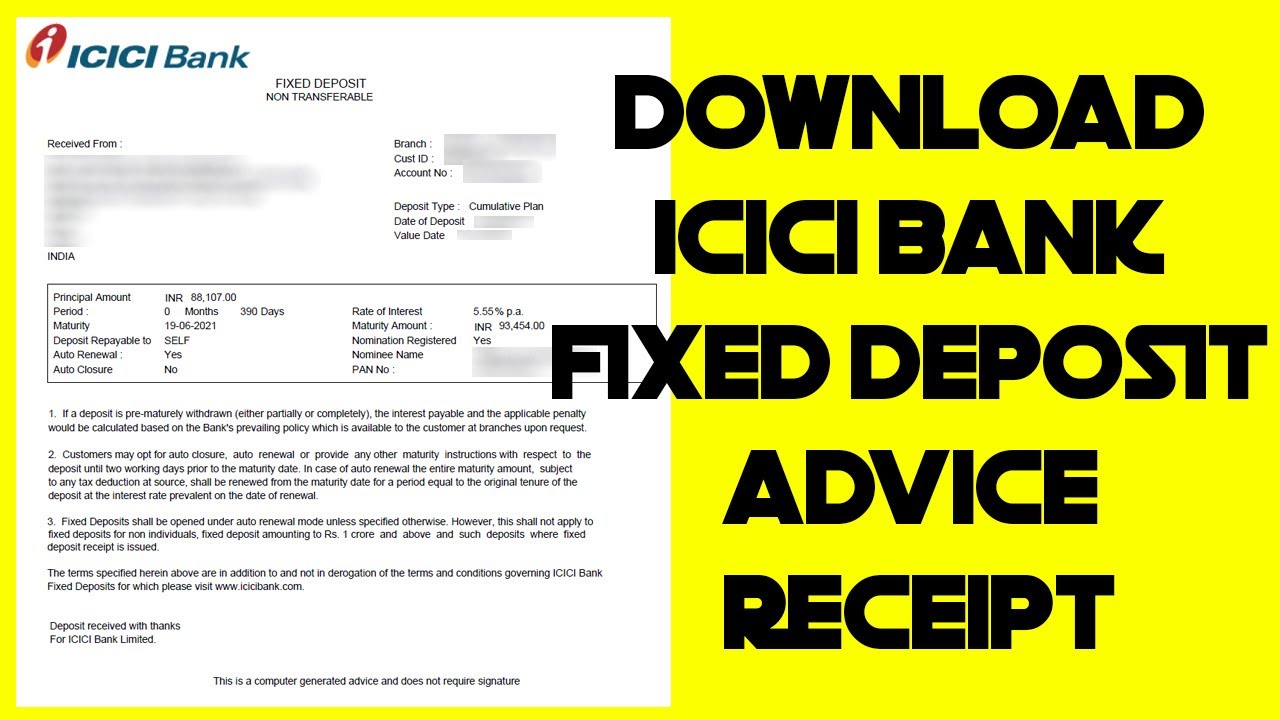

How To Download Icici Bank Fd Advice Receipt Fd Certificate From Icici Bank Icici Bank Bank Advice

Pin By Imran Malik On Informing International Roaming Self Service Self

Institute Of Chartered Tax Practitioners India On Twitter How To Plan Indian House Plans Incorporated Company

Pin By Capital Title Houston Beaumo On Capital Title Realtor Resources Informative Open House Title

Deductions For Freelance Event Planner Infographicbee Com In 2022 Tax Deductions Deduction Online Taxes

Apa In Text Citations Apa Essay Apa Essay Format Essay Format

Tds Due Dates Due Date Generation Make It Simple

Pin By Ash Prasad On General Fyi Gsm Paper Printer Types Laser Printer

Amazing Certificate Of Conformity Template Certificate Templates Certificate Of Completion Template Free Certificate Templates

1929 Abstract Of Title Yamhill Oregon Pioneers 14 Pgs Mortgage Letter Plot Map Plot Map Lettering Map

Irs Response Letter Demozaiektuin Within Irs Response Letter Template 10 Professional Templates Ideas 1 Letter Templates Lettering Letter Writing Template

Pin By Sanjeev Sharma On Joining Lettering Life Quotes Career Opportunities

Tax Write Off Opt In Freebitcoin Yeahright Bookkeeping Business Business Tax Business Tax Deductions

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Form Example Job Application Template Standard Form Math