lakewood co sales tax online filing

You may now close this window. This is the total of state county and city sales tax.

Ford Ecosport For Sale Lease Denver Lakewood

File Sales Tax Online There are a few ways to e-file sales tax returns.

. Make the check or money order payable to the Colorado Department of Revenue. Recent Colorado statutory changes require retailers to charge collect and remit a. After you create your own User ID and Password for the income tax account you may file a return.

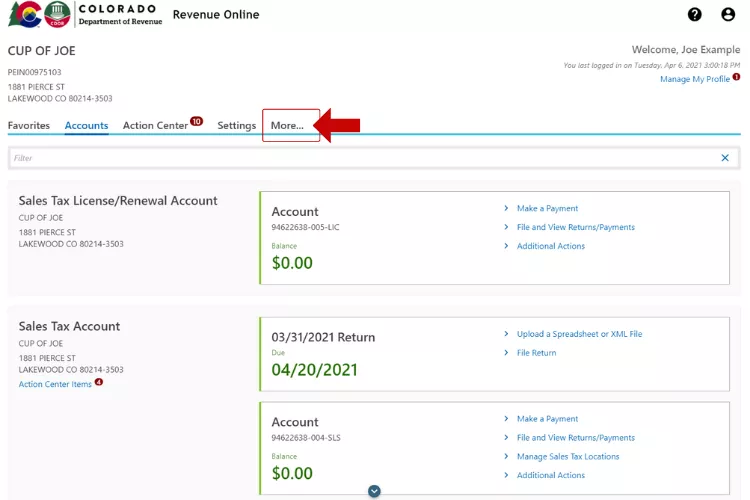

The Lakewood sales tax rate is. License file and pay returns for your business. Wednesday May 5 2021 40400 PM Denver CO.

File your state income taxes online. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. Get rates tables What is the sales tax rate in Lakewood Colorado.

Lakewood Business Pro Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. City salesuse tax return. Lakewood co sales tax online filing Thursday April 21 2022 Edit.

Starting September 1 2021 taxpayers who wish to pay their quarterly estimated tax bills. File Sales Tax Online. You have been successfully logged out.

Community government and strategic partnerships allow Lakewood to provide your business with all the information necessary to succeed and thrive in our community. The tax rate for most of Lakewood is 75. The Lakewood Sales Tax is collected by the merchant on all qualifying.

Sales Tax Return Due Date Sales and use tax returns are due on the 20th day of each month following the end of the filing period. For the correct version go to the Sales Use Tax Forms web page. Tax rates are provided by Avalara and updated monthly.

File State Sales Tax information registration support. Each location has its own Gross Sales and Services amount so each location should. Report gross sales per site location.

Payment After Filing Online If you filed online or with a tax software and want to pay by check or money order. The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

Create a Tax Preparer Account. For tax preparers CPAs and filing practitioners who manage. The Lakewood Colorado sales tax is 750 consisting of.

Businessnameusa registersfiles and pays for filing fees and also provides information and. Learn more about sales and use tax public improvement fees and find resources and. Revenue Online ROL File state taxes and manage your state tax account.

We cover more than 300 local jurisdictions. This is the total of state county and city sales tax rates. Sales tax id lakewood co Selling Online.

Lakewood co sales tax online filing.

Used Jaguar Near Denver Littleton Co Jaguar Lakewood

Hands On Quickbooks Training Classes Lakewood Co Computers Provided

How Colorado Taxes Work Auto Dealers Dealr Tax

The Lakewood Plan Homeownership Taxes And Diversity In Postwar Suburbia History Society Kcet

Registering With The Ohio Department Of Taxation Department Of Taxation

How Colorado Taxes Work Auto Dealers Dealr Tax

Send A Secure Message In Revenue Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Taxes And Fees In Lakewood City Of Lakewood

Top 10 U S Metros Where Foreclosure Filings Are On The Rise Attom

Washington Sales Tax Calculator And Local Rates 2021 Wise

Inventory Larry H Miller Volkswagen Lakewood

Pre Owned Acura Ilx For Sale In Bradenton

Taxops Response To The New Colorado Delivery Fee Taxops

Terumo Bct Global Headquarters 11158 West Collins Avenue Lakewood Co Office Building

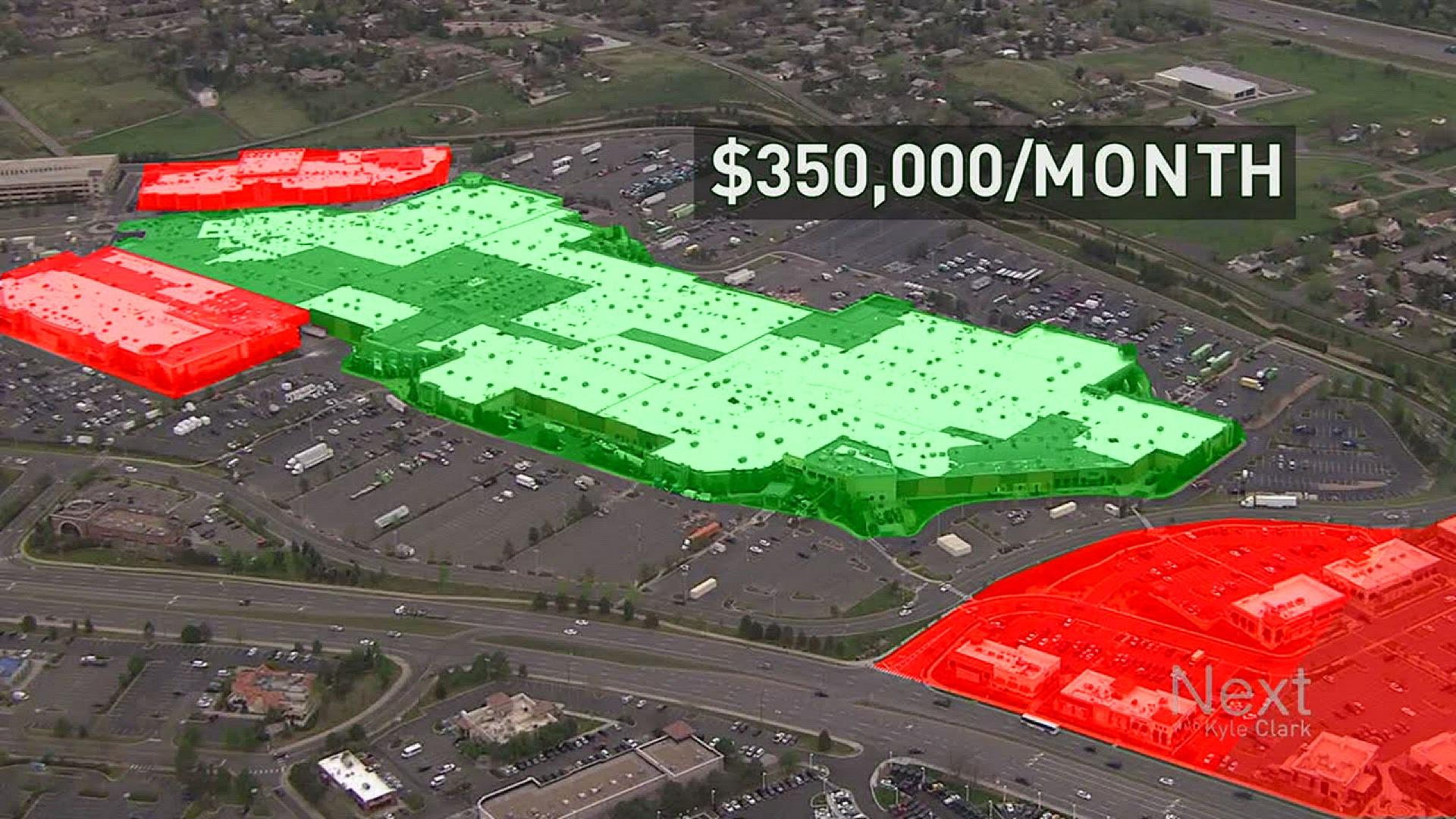

Colorado Mills Closure Means Lakewood Could Lose 350 000 A Month In Taxes 9news Com

Business Licensing Tax City Of Lakewood